It’ll likely go down as the biggest IPO of the year.

Beyond Meat (NASDAQ: BYND), the company that makes a pretty spectacular plant-based burger, debuted less than two months ago.

Since then, the stock has climbed more than 313%.

Those who got in early made a boatload of cash.

Those who are chasing it now, however, are going to lose a lot of money.

Although Beyond Meat is a solid company that will do very well in the coming years, those who choose to buy the stock now are going to lose a fair amount of cash.

The bottom line is that chasing stocks like these — after all the big money has been made — is a very easy way to lose money.

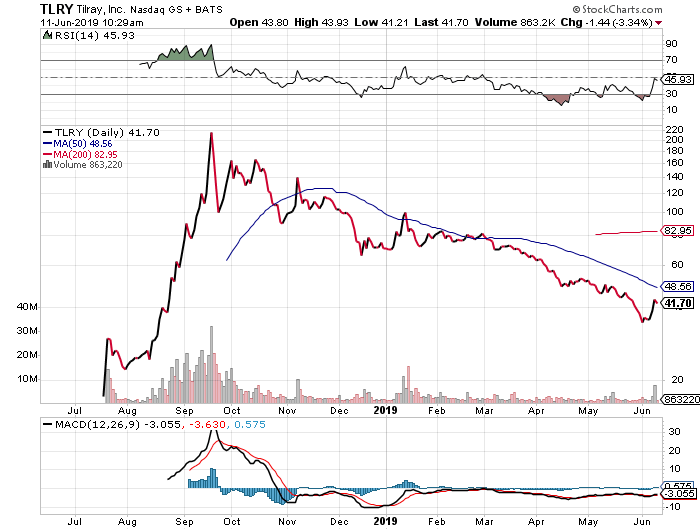

Certainly we saw this with cannabis producer and distributor Tilray (NASDAQ: TLRY), which went public last year.

That stock launched out of the gate like a juggernaut, making early investors small fortunes but setting up the latecomers for huge disappointment.

Take a look at what happened to Tilray after the enthusiasm wore off and reality set in:

Of course, those who got in early couldn’t care less. And who could blame them? They made a fortune.

Truth is, I’m always looking for new ways to get in early on stocks just like these, then unload them at their peaks. That’s actually when you see a flood of buyers willing to take your overvalued shares.

And these don’t have to just be IPOs.

In fact, I spend a lot of time finding undervalued stocks, buying them on the cheap, and then selling them on quick upward moves.

I even started a small trading group that does nothing but buy and sell these stocks — on a weekly basis.

It’s called the Weekly Score, and since launching it earlier this year, I’ve locked in 10 double-digit gains, with only three losers.

But I’m not telling you about this to brag.

Instead, I’m telling you about this to point out an opportunity for you to make a ton of cash. And relatively fast, too.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

My Next Big Winner

My most recent pick is a company called 48North Cannabis Corp. (OTC: NCNNF)(TSX-V: NRTH).

This is a licensed Canadian cannabis producer that recently fell into “undervalued” territory.

You see, two months ago, the company did a $25 million financing, which was then followed by another $6.8 million financing.

Then, last month, the company accelerated its warrant expiry date, which will give it an extra $13.5 million.

With all that cash, 48North is planning to make some big moves, but most investors aren’t paying attention to these details.

What makes this particularly interesting, too, is that earlier this week, the company announced that it signed a supply agreement with the only cannabis wholesaler and online retailer of recreational cannabis in Ontario.

You don’t need to be a rocket scientist to figure this one out. Which is why I personally picked some up while it’s still cheap.

48North is about as undervalued as they come, and hardly anyone on Wall Street is paying attention. And this is why I’m in.

Truth is, what I see with 48North is what I’ve seen in the past on every one of the double-digit trades I’ve pulled in this year: opportunity. And there are plenty more of these to come — at least 31 more this year, as I make new trades every single week.

I’d be happy to share my next trade with you if you’re interested.

Just click here to get your name added to the list.

Or, if you want to learn more about my process of identifying and, of course, capitalizing on these trades, click here now.

To a new way of life and a new generation of wealth…

Jeff Siegel

Jeff is an editor of Energy and Capital as well as a contributing analyst for New World Assets.

Want to hear more from Jeff? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

@JeffSiegel on Twitter

@JeffSiegel on Twitter