Everywhere you turn these days, the shale boom under way in the United States is on the radar…

The U.S. has a hundred year supply of natural gas.

This is the key to our energy independence.

Natural gas is the new, cleaner coal.

The optimistic rhetoric is endless. And it’s true — we are looking at a massive supply of domestic shale gas.

It’s not quite clear whether it’s actually a hundred years’ worth, and it’s unlikely this resource alone could render us energy independent. But it’s encouraging all the same.

Right now, the main rival to natural gas is coal. And so far, natural gas is putting up a good fight…

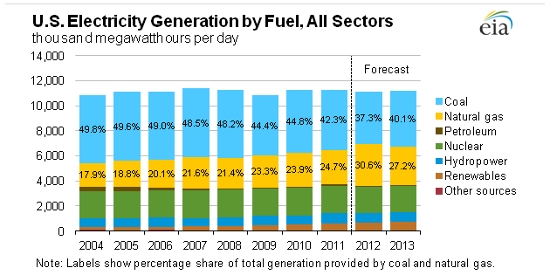

Between 2008 and 2011, natural gas has increased its percentage of electricity generation from 21.4% to 24.7%. This year it’s projected to jump even more than those four years combined, increasing to 30.6%.

Coal, meanwhile, has dropped from 48.2% to 42.3% in the same period, and this year it will likely fall to 37.3%, as the chart from the EIA shows:

And natural gas prices have been very low, falling below $2 per million British thermal units (mmBtu) to a ten-year low in April this year.

Coal prices stayed well above $2 mmBtu.

An EIA report out this week showed the cost of coal transportation via railroad has nearly doubled between 2001 and 2010, another factor that has boosted prices.

Transportation accounts for 40% of the cost of coal, and 70% of all coal is shipped by railway. As a result, coal prices increased steadily in that decade.

This year the EIA expects coal prices to average $2.40 per mmBtu. Despite its price dip, natural gas will likely be more, averaging $2.77 per mmBtu.

But natural gas is cleaner and easier to transport. Pipeline infrastructure is still sparse relative to the amount of natural gas retrieved from wells, but it’s the preferred form of transportation.

Coal can’t exactly move through pipelines.

Natural gas seems to be the way of the future. But it’s not the new coal… not yet.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

A closer look at the EIA’s forecast in the chart above shows that although natural gas will jump to 30.6% of the total electricity generation, and coal will fall to 37.3% this year, this trend will shift again next year.

Natural gas will fall back to 27.3%; coal will move up to 40.1%.

Meanwhile, coal prices are expected to increase to $2.44 per mmBtu next year, but natural gas prices will jump to $3.42 mmBtu. That’s almost a full dollar more than coal.

The EIA projects coal consumption will head north again to as high as 92.74 million short tons in 2013 after the sharp decline in April of this year to 56.98 million short tons.

Jeff Siegel gave the contrarian viewpoint to the shale gas boom this week, explaining the main reason the shale boom is so hyped up could be because it is so hyped up.

Like I said in the beginning, everywhere you turn, the shale boom is on the radar. As a result, everyone wants in.

Who really knows whether it’s really all it’s cracked up to be?

Coal, on the other hand, is a tried and true method of electricity generation in the United States. There’s no doubt coal companies are hurting right now as coal-fired plants switch to cheap natural gas. But natural gas won’t remain cheap for very long…

Even if we do have a hundred years’ supply, seven companies have proposed LNG export terminals that are under review. One more has already been approved. Natural gas exports will drive up demand… and prices.

Not that it won’t be good for the industry; plenty of shale companies — both small and large — will benefit from this boost in demand.

But it will also open the way for more coal. So don’t discount America’s biggest electricity source just yet.

Good Investing,

Brianna Panzica

for Energy and Capital

Solar Installations Continue to Grow: Key to Profitability is Cutting Costs

The key to successful clean energy is to lower the cost, not to reinvent the wheel. But that’s precisely what failed solar companies like Solyndra were trying to do.

Buy and Hold is Dead: The Buy and Hold Fallacy

All you’ll ever hear from major brokerages and financial institutions is advice based on a “buy and hold” strategy. The truth is, “buy and hold” is dead. It doesn’t work and it never has…

The Secret Gold Sell Signal: What this Little-Known Signal is Telling Us Now

This little-known gold signal called the last two gold bull markets as well as the bear in between. If you own gold or are thinking about owning gold, you want this call in your playbook. Act now, avoid future regret.

Shale Gas Investment Opportunities: THIS Could Kill America’s Shale Boom

Is the shale gas boom about to bust?

How a Democrat Made an Extra $200 Million on Obama’s Reelection: Not Everybody’s Losing Money…

The market is unbiased. It rewards good ideas. It punishes bad. It doesn’t care if a Republican or Democrat is in the White House; it only cares if the investment capital under said administration will be fruitful… period.

California Oil Production: Is This a Fool’s Oil Rush?

Editor Keith Kohl explains why California’s shale boom may never even get off the ground.