Taking a bullish stance on natural gas isn’t easy. Not by any means.

Ever since 2008 — when we saw energy prices get decimated within just a few short months, turning investors bearish practically overnight — nobody seems willing to look down the road.

And who could blame their pessimism after witnessing this…

That’s bound to happen when our domestic production is consistently hitting new records. Our total gas output this year is on track to top more than 29 trillion cubic feet (remember, that includes the steep decline in the number of rigs drilling for natural gas, which was nearly cut in half during 2012).

That’s bound to happen when our domestic production is consistently hitting new records. Our total gas output this year is on track to top more than 29 trillion cubic feet (remember, that includes the steep decline in the number of rigs drilling for natural gas, which was nearly cut in half during 2012).

Today the natural gas industry has become a place where bearish investors are suddenly turning bullish.

Go ahead and look, the numbers won’t lie to you…

Where Bullish Bears Roam

Before I go on, it’s important to note this bullish outlook for natural gas isn’t a side-effect of raging speculation over future U.S. LNG exports. I’ll touch on some of my reservations toward that debacle later next week, but for the moment, we’ll stick to our home turf — which is where we’ll be directing our natural gas supply.

Production may be at record levels, but so is demand.

We’re using nearly 70 billion cubic feet of natural gas every day. And slowly but surely, it’s beginning to displace coal in the industrial sector.

You see, coal simply isn’t able to stay competitive in this low-price environment (and coal will still remain our biggest source of electrical generation for years to come).

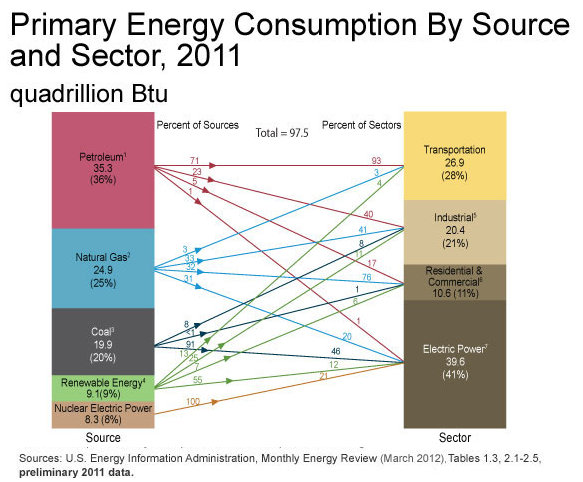

As you can see below, natural gas is evenly divided among three sectors.

It’s enough to get even the most stubborn of bears on board.

Two Win-Win Natural Gas Investments in 2013

Ever wonder what will make a bear turn bullish over natural gas?

A simple guaranteed winner.

It’s that easy.

I’m talking about a company that allows individual investors like us to pocket cold, hard cash, no matter what happens to the price of natural gas.

Sound impossible?

That’s an understandable concern, given the current gas glut…

But take a second to look at that natural gas price chart again. I know it isn’t a pretty sight — and the oversupply we’ll have over the next few years eliminates all hope for a price spike — but it’s also created an overabundance of bearish sentiment in the market.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

Last year I called Linn Energy the only sure bet in natural gas; so far it’s been able to flourish as natural gas prices collapsed 76% from 2008 highs.

There’s no question that this has become one of the few must-own natural gas stocks for 2013:

But I want to point out that this pick’s appeal is not solely the fact that shares have jumped almost fourfold during a period when natural gas prices crashed, falling below $2.00/Mcf last April…

No. The most attractive part, dear reader, is the nearly 8% yield the play comes with — a dividend that has been steadily rising despite all the volatility to hit the market throughout the recession.

And it turns out I’m not the only bull in the room when it comes to the long-term profitability of natural gas.

“It’s a win-win scenario for me, even if prices never climb higher. Its actually better for these stocks if we don’t see a price increase ever again,” my colleague Christian DeHaemer told me when he stopped by my desk this morning — as if he were hoping for another crash.

That’s the trick to finding upcoming natural gas profits…

Forget the low prices and even the oversupply; having a cheap, abundant source of energy at our disposal will be the catalyst for a radical switch in the way we view our future energy security.

Until next time,

Keith Kohl

A true insider in the technology and energy markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the Managing Editor of Energy & Capital, as well as the investment director of Angel Publishing’s Energy Investor and Technology and Opportunity.

For nearly two decades, Keith has been providing in-depth coverage of the hottest investment trends before they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on key advancements in robotics and AI technology.

Keith’s keen trading acumen and investment research also extend all the way into the complex biotech sector, where he and his readers take advantage of the newest and most groundbreaking medical therapies being developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s to lab scientists grinding out the latest medical technology and treatments. You can join his vast investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.