I was in shock last week.

After looking over the latest entries to top my 9 Things We’ll See Down the Back Side of Peak Oil list, I came across a comment that blindsided me.

(By the way, you still have a little bit of time to toss in your own entries, if you haven’t gotten a chance to do so… )

It wasn’t some clever or humorous poke at life after peak oil. Rather, it was a simple question that stood out from every other e-mail I had received.

In a nutshell, the poor guy had never even heard of peak oil.

Now I realize that there are people who haven’t ever heard of peak oil, and I do occasionally encounter the random passerby with a lot of questions on the subject. But I certainly didn’t expect for that passerby to be one of my readers.

I can forgive him because he was quick to admit that he’d only recently joined our ranks. And I shouldn’t expect every one of you to know about peak oil… should I?

Peak Oil is Not a Myth

Peak oil is not a myth. It isn’t a concept created in the boardroom of some secret meeting amongst oil companies, conjured up as a way to scare people senseless.

Peak oil is very real.

Don’t believe me?

The U.S. and Mexico are poster children for peak oil theory. For those of you that scoff at the notion and dismiss it as foolishness, consider the following…

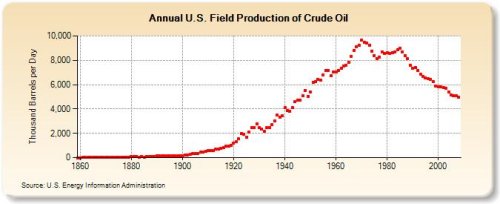

In 1970, the U.S. was at the height of its oil production. That year, U.S. fields produced 9.6 million barrels of crude oil per day. Things were on the rise. During October and November of 1970, U.S. production had increased to more than 10 million barrels per day.

Unfortunately, those two months were the last time Americans smiled about domestic oil production. Since then, U.S. production has been in decline.

Take a look for yourself, courtesy of the Energy Information Administration (EIA):

I can only imagine what some people said at the time… probably something to the effect of, "Things will pick up again… don’t worry."

To this day, Texas remains our leading producer. Yet Texas production doesn’t give us much to smile about; production there has been in trouble for decades.

But, before the doom and gloom takes over, remember that Texas is still our largest oil producing state, and that fact isn’t going to change anytime soon.

And there is at least one area of the United States where production is increasing. (I’ll get to that in just a minute.)

Mexico’s Peak Oil Trouble Continues

If the U.S. is a good example of a country sliding down the back side of peak oil, Mexico’s Cantarell field is our second lesson.

First, meet the Ku-Maloob-Zaap oil field. Ku-Maloob-Zaap is currently Mexico’s most productive oil field, mostly thanks to three large fields: Ku, Maloob, and Zaap. The offshore fields produce more than 800,000 barrels of oil per day.

The only good news about Mexico’s oil production is still bad news: Pemex recently announced that oil production is still falling, but at a slower rate than in 2009.

News wasn’t always bad. I remember when the Cantarell field was pumping out more than two million barrels of oil per day in 2003. Of course, that’s after Pemex began injecting Nitrogen into the field. A year later, the Cantarell field was forecast to decline by 14%.

By July 2008, when oil prices were peaking at $147 per barrel, people were recklessly throwing money at the oil industry. I can’t really blame them — analysts were screaming for oil prices were heading to $200 per barrel by year’s end.

For Cantarell, things weren’t as cheerful as the oil price projections. That July, production had fallen 36% compared to the previous July. What once was the second largest oil field in the world was producing approximately 973,000 barrels per day. By 2009, production had dropped another 38% to about 770,000 barrels per day.

Don’t be surprised when Mexican oil exports completely dry up in the next five to ten years. As if that weren’t enough to worry about, think of how much trouble the country will be in after losing their oil revenue, which makes up 40% of the government’s budget.

Due to lower oil prices in 2009, Mexico lost out on approximately $23 billion in oil revenue. Perhaps Mexico is destined to become America’s 51st state.

The Other Side of the Fence

Earlier, I told you not to let the doom and gloom take over; there is a bright spot amidst the dark news for oil production.

One state has been having tremendous success lately: North Dakota. According to data from the EIA, North Dakota oil production has been on the rise for more than six years.

This boom is the reason that readers of the $20 Trillion Report have closed 22 straight winning positions… and the best part is the profit run is far from over. Take a minute and read more about how you can join in the wild profit taking.

Looking Forward…

Today was just a starting point.

The fact is there’s too much to learn about peak oil than one can possibly cover in a day. Next week, I want to show you why we can’t rely on the mighty OPEC to save us from a global peak in oil production. If nothing else, you’ll understand why they can’t be trusted.

Stay tuned.

Until next week,

Keith Kohl