On Wednesday, militant forces attacked an Algerian natural gas field.

Varying reports claim anywhere from 50 to 132 hostages were taken from the site by an al Qaeda-linked group after it attacked the In Amenas facility jointly owned by Statoil (NYSE: STO) and BP (LON: BP).

The attack was followed by a raid by the Algerian military in an attempt to foil the assailants. Claims that 35 of the hostages are dead have been reported.

Regardless of what the details turn out to be, the attack is undoubtedly tragic. Some news agencies are reporting hostages escaped; others say a large number were freed; still others are reporting only a few are alive, and still held by kidnappers.

Needless to say, the extent of the effects are unclear.

But what is clear are the implications this attack will have for oil…

Algeria is one of OPEC’s twelve members. The nation produces almost 1.2 million barrels of crude oil per day and is responsible for 698,000 bpd in crude oil exports and 52.02 billion cubic meters in natural gas exports. The United States is one of its major customers, importing an average of 358,000 barrels of crude per day in 2011 and 186,000 bpd in October last year.

This attack, analysts have said, will take 24 million cubic meters a day of gas and 60,000 barrels a day of liquids offline — and no one can say how long this production halt will last.

Price Surge

In the midst of the turmoil overseas, the U.S. reported a sudden and significant drop in oil stockpiles.

Contrary to the gain analysts expected, U.S. oil stocks dropped by more than one million barrels last week.

Between these two pieces of news, oil prices surged.

On Wednesday, crude for February delivery was gaining on $95 a barrel, and on Thursday it broke that mark, rising to as high as $96.04 during the day before settling back down.

But this could mark the start of an even bigger climb in oil prices, which have been flirting with the $100 mark.

Nick Hodge told you this week that $100 oil is just around the corner. The price has been hovering just below that level for a while.

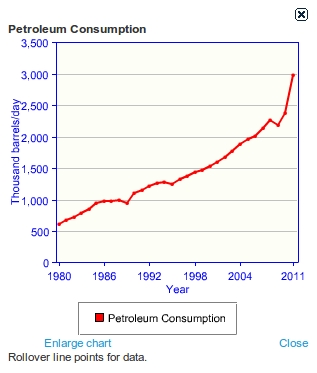

Demand will keep increasing… production, on the other hand, will not. Compared to consumption, production will taper off.

Some of this might be a result of rising consumption from the producing nations. Saudi Arabia, for example, has seen demand increase, particularly in the last five years:

But some will also be a result of continuing geopolitical tensions.

The attack in Algeria is just the latest of these problems. Libya’s production is only just recovering after the civil war that all but stopped oil exports. Iran’s exports have fallen dangerously low — particularly for a nation whose budget relies on oil revenues — after its covert nuclear program sparked Western sanctions.

And when oil supplies are low, prices are sure to be high.

The World’s New Biggest Oil Producer

U.S. oil production, meanwhile, continues to grow. The report of falling stockpiles, while not good news, was countered by the fact that supplies are still higher than they would normally be this time of year.

Domestic oil production is at a 20-year high — but it’s not stopping there…

The IEA expects the U.S. to surpass Saudi Arabia, the world’s biggest oil producer, in about seven years.

This means domestic production will provide a safe ride for the decade to come.

Then again, so will crude oil in general. Because prices are going to continue to ride high — and move even higher — as rising consumption battles with struggling production overseas.

If you prefer to stay domestic, there are still companies that will provide safe entryways into U.S. oil production.

Threats on international oil reserves are going to push the price of oil up — and that means increased demand for growing U.S. production…

Don’t miss your chance to profit.

Good Investing,

Brianna Panzica

for Energy and Capital

Are YOU a Contrarian Indicator?: Investments Tend to Surge at Market Tops

Did you invest money in the U.S. stock market last week? If you did, you may have just bought a short-term top in stock prices.

Oil Pipeline Investing: Could THIS Man Kill TransCanada’s Pipeline?

A long-delayed decision is drawing nearer, and the fate of TransCanada’s XL Pipeline is in this man’s hands.

When to Sell: Is the Market Cheap? How You Know…

When do you have to sell your 401(k)? When should you? Is the market cheap? How do you know? Check out this long-term P/E chart of the S&P and decide for yourself…

On The Constitution, Gun Rights, Criminal Bankers, and Silver: Buy a Gun, Buy Silver

The Federal Reserve has never been an agent of the government; it is a creation of the bankers. You see, the government cannot control the banks because the banks control the government.

A Flood of Unconventional Gas: Shale Gas Profits

Editor Keith Kohl explains why shale gas production is the key to our cheap, abundant alternative to crude oil.

What Are You Paying For?: Pros are Getting Paid to Underperform

Ignore their hype. Managed funds are terrible. You’re better off on your own and here is why…

Crude Oil Investments: Get In Tune, Get In the Money

We need to start producing at least 8 million more barrels of oil per day in the next few years. Because the world has never increased crude production this fast, I’m extremely bullish on crude oil and the companies that will be producing it.

Germany Starts a Central Bank Run: The Bundesbank Starts a Run on Gold

Everything the Bundesbank does is close to perfection. The very fact that it is calling in its gold is monumental in terms of questioning the “full faith and credit” of the United States Treasury…

The Government Said I Lied About the Bakken: Why Being Ahead of the Curve Makes the Establishment Uncomfortable

In January 2008 I commissioned my research staff to investigate and to produce a report on the Bakken. I gave them two months to give me their findings… They did it in one.

Shale Gas 101: U.S. Shale Formations

Energy and Capital‘s Keith Kohl takes a closer look at three of the top shale gas plays in the United States.