Editor's Note: Before we get into your free report, "The Top 3 Stocks For Lithium’s 4,000% Rise," I wanted to share this pertinent message from Alex Koyfman regarding a MASSIVE lithium discovery that could change the game. Enjoy…

World's Richest Lithium Deposit Worth Trillions

An Oregon State University geologist just exposed the single largest lithium deposit known to man…

This American lithium deposit dwarfs anything else on Earth.

With up to 120 megatons of lithium at this remote site…

It’s potentially more than 10 TIMES the size of the next largest lithium deposit in the world.

It contains enough lithium to produce batteries for 10 billion smartphones (more than one for every person on Earth).

And enough to build 600 million Tesla Model 3s (more than two for every single driver in the U.S.).

Or enough to supply more than 60 times the total number of electric vehicles sold worldwide last year.

And the crazy thing is that almost nobody knows about this record-setting deposit.

Because when an unassuming geologist from Oregon State University first published this groundbreaking geological conclusion…

The story was buried in a sea of more flashy political and economic headlines.

To the average viewer, it just isn’t attention-grabbing enough — not in the context of today’s dopamine-driven media circus.

But to the more discerning of us out there, it is a bright and glaring opportunity only a fool would ignore.

And now one little-known firm has a massive head start in mining this world record-breaking deposit…

It plans to begin extracting the critical resource in a matter of months… with an initial production goal of 40,000 tons of lithium per year.

And customers are already lining up to get their hands on as much of it as possible, like General Motors.

The American auto giant has poured $650 million into this little-known company.

And you can claim your stake in their mining operation today before its share price explodes into the stratosphere.

Go here now for the complete story.

Investor Report: "The Top 3 Stocks For Lithium’s 4,000% Rise"

Goldman Sachs is calling it “the new gasoline.”

The Economist has called it “the world's hottest commodity.”

Energy experts have dubbed it the "oil" of the future.

I'm talking about lithium: a one-of-a-kind element used in consumer electronics, computers, and communication — think everything from cellphones all the way up to electric vehicles… basically anything necessitating a compact, rechargeable power source.

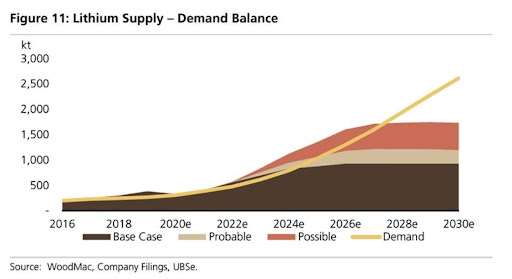

Demand is going to soar in the coming years. The main driver for this explosive lithium growth is the rechargeable battery sector.

Rising prices of lithium, cobalt, and carbon are not a bubble. They are underpinned both by rapid growth in electric vehicle sales and tight supplies.

Electric vehicles (EVs) are expected to make up 35% of the automotive market by 2040. Just as importantly, Elon Musk’s prediction that long-range EVs would be available for less than $30,000 by 2023 came true – two years early. Several long-range models from Audi, Nissan and Hyundai already cost less than $30,000 after tax credits.

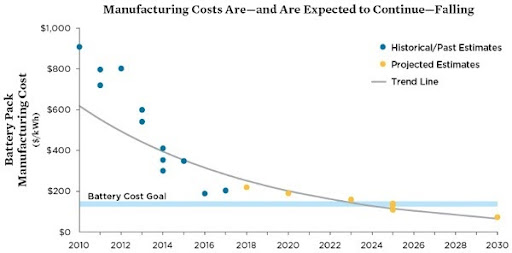

Again, this all goes back to batteries, which have seen a huge reduction in cost that will continue.

Estimates indicate that the cost of “fueling” electric vehicles is a fraction of the cost for conventional gasoline vehicles. The cost to charge an EV is around $0.14 per kilowatt-hour, while a gallon of gas currently averages $3.38.

The average lifetime maintenance cost of an EV is roughly $4,600, while the average gas car costs twice as much – $9,200 on average – in mechanic bills over its lifetime. .

In addition to getting cheaper, these batteries are also getting more efficient. New and second-generation plug-in models can go farther on a single charge than their predecessors. And this is key.

The Tesla Model S has a 400-mile range. Audi's Q4 e-tron is up near 300 miles of range and is already considered the cheapest electric Audi, starting at around $49,800.

These technological advancements have accelerated sales. Furthermore, they’ve demonstrated a significant competitive advantage for car companies which master them. It’s a race to build the best battery. The manufacturer with the most efficient, cost-effective and potent battery wins.

Furthermore, such batteries are essential for renewable energy sources, specifically wind and solar. The need to store power for prolonged periods requires the kind of industrial-grade capacity that only advanced lithium batteries can deliver. That's added another nice tailwind to lithium demand.

Data compiled by Allied Market Research suggests that the global lithium-ion battery market is expected to grow at a compound annual growth rate of 18% to reach $129.3 billion by 2027.

So how can investors play it?

The Lithium Stocks We're Watching

- Albemarle Corporation (NYSE: ALB)

- Arcadium Lithium PLC. (NYSE: ALTM)

- Ganfeng Lithium (OTC: GNENF)

Albemarle (NYSE: ALB) owns and operates a mine at the Salar de Atacama project in Chile and the Silver Peak mine in Clayton Valley, Nevada. Albemarle is a $14.33 billion market cap diversified chemical corporation and is not a pure play on lithium production, though it is positioning itself as the face of the lithium mining industry.

Arcadium Lithium PLC (NYSE: ALTM) is a relatively new player in the lithium market, formed on January 4, 2024 through the merger of two established companies: Livent Corp. and Allkem Ltd. This merger makes Arcadium Lithium one of the largest lithium suppliers globally, with a diversified portfolio of mining and refining assets across key regions.

Ganfeng (OTC: GNENF) is also a pure play. Ganfeng Lithium Co., Ltd. is a Chinese company that produces lithium, lithium products, other metals, and batteries. It is the world's largest lithium producer by production capacity, and it has a wide range of operations across the lithium battery supply chain, from mining and refining to battery manufacturing and recycling.

While the lithium industry has struggled the last 2-3 years, we are starting to see a pulse…

You've heard the age old addage "Buy when there's blood in the streets." Well, my dear reader, the lithium streets have been flooded with blood for years. It's time to make some moves and stake your position.

Some Bonus Picks

Pilbara Minerals (OTC: PILBF) developed the Pilgangoora project in the iron ore-rich Pilbara region of Western Australia. The lithium-tantalum project is 100% owned by Pilbara and is one of the largest hard-rock lithium deposits in the world.

The Pilgangoora project is currently in Stage 2 of a three-stage expansion process for the mine. Company reports have stated that it is waiting until “such time that market demand and/or participation of a partner at Pilgangoora is sufficient to justify its development.”

Both stocks have posted impressive performances this year…

As lithium demand increases over the years, Pilbara and Orocobre’s stock prices should follow suit.

There's also the Global X Lithium & Battery Tech ETF (NYSE: LIT), which seeks to track lithium's price movement.

The fund is a great way to track the overall lithium market while investment and demand grow over the next few years into unparalleled territory in the coming decades.

Included in the holdings of the ETF are miners, chemical companies, battery manufacturers, and other industrial companies.

By diversifying the exposure to lithium, the Global X Lithium & Battery Tech ETF provides investors with less risk and the potential for long-term reward.

And our last bonus pick is Sociedad Química y Minera de Chile S.A. (NYSE: SQM). The company plays a crucial role in the global lithium market, supplying a significant portion of the lithium used in electric vehicle (EV) batteries, making it integral to the growing renewable energy sector. The company also pays a sturdy dividend, currently above 4%.

A $1.5 Trillion Lithium Volcano

As we mentioned before the start of your report, an Oregon State University geologist just made a MASSIVE discovery.

One that is 16 million years in the making. Experts are saying this might be "the single most important geological discovery of our generation."

If you're looking for the market's next big stock story, and an unknown lithium play with a lot of potential, take a second and consider this true piece of history…