We’ve been patiently waiting for years to capitalize on the LNG trade.

And up until now, Qatar has quietly dominated the global LNG export market, accounting for about one-third of the global LNG supply in 2014. Last year, the country exported a jaw-dropping 77 million tonnes of liquefied natural gas.

And there’s a good reason Qatar is on top… the country holds the second-largest proven gas reserves on the planet currently:

-

Russia: 1,688 trillion cubic feet

-

Qatar: 885.29 trillion cubic feet

-

U.S.: 338.26 trillion cubic feet

-

Saudi Arabia: 290.81 trillion cubic feet

However, you and I both know that thanks to the combination of hydraulic fracturing and horizontal drilling, the United States has quickly become the world’s largest producer of natural gas — and all within the span of a few short years!

Yes, dear reader; it turns out that our shale boom gave us more than just a glut of oil.

And even with the oil price war being waged by Saudi Arabia right now, U.S. oil and gas companies are still achieving record drilling efficiencies, lowering the breakeven cost at virtually all of the country’s largest tight oil and gas plays.

That certainly goes for players in the Marcellus, too. Below, you’ll see that new-well gas production per rig has helped push production in the play to record heights since 2009:

Click Image to Enlarge

I’ll give you three guesses as to what the next logical step is for the U.S. natural gas industry, but you’ll only need one…

U.S. LNG: Time to Go Global

Make no mistake about it; the United States is on the verge of tapping into the global gas market.

Unlike with crude oil, the U.S. doesn’t have as many restrictions on natural gas exports. In fact, the United States has been supplying both Mexico and Canada with natural gas for decades.

Now, up until LNG exports became a reality for the United States, companies were restricted to our two neighbors due to the fact that natural gas is transported via pipelines — which is the reason gas markets are regional.

The emergence of the LNG market, however, means that natural gas has gone global.

Right now, applicants from all over the country are vying for approval to contract their supply to non-free trade countries, which will allow the U.S. to sell its LNG overseas.

Let’s be clear: The world is in dire need of this supply.

Understand, Russia doesn’t have the same shale potential as the United States, especially from a technical perspective, which means Putin simply can’t tap into his country’s massive gas reserves.

And President Putin has been known to not only charge ridiculous prices for Russia’s natural gas to consumers in Europe but actually cut off supply if European buyers refuse to cooperate.

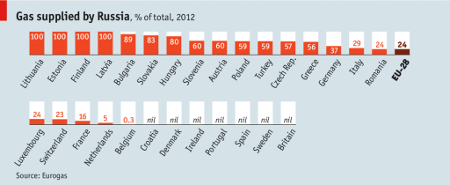

For EU members that rely heavily on Russia for its gas supply, you can understand why they’re looking for a better, more attractive gas source.

Here’s a look at how crucial Russian gas is to its neighbors:

Click Image to Enlarge

Europe isn’t alone, either.

Japan has quickly grown into a major LNG importer. After the deadly Fukushima disaster in 2011, the country cut off its use of nuclear power for several years, falling back on natural gas to pick up the slack.

Even though some of Japan’s nuclear capacity has recently come back online, its natural gas consumption has jumped and now accounts for one-quarter of its energy needs!

Truth is, Japan is now the world’s largest LNG importer, and much like Europe, it’s looking to diversify its supply list.

That presents a huge opportunity for U.S. LNG players… so what’s the obvious next step?

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

Investing in U.S. LNG Exports

Look, there’s no question that Qatar’s natural gas exports have made it the richest country in the world, and Russia’s massive reserves have made it Europe’s — and much of Asia’s — biggest gas supplier.

And there’s no reason the massive supply glut in the U.S. can’t be put to good use by allowing companies to reach a global platform.

Right now, there are a total of five Federal Energy Regulatory Commission-approved LNG export facilities in the U.S.: two in Texas, two in Louisiana, and one in Maryland.

Naturally, the Southern terminals close to the Gulf of Mexico will become the first major hub for U.S. LNG exports. Let’s also not forget that these facilities will have direct access to natural gas being extracted in both the Eagle Ford in South Texas and Louisiana’s Haynesville Shale.

Now, although the Maryland terminal seems to be the outlier here, it does have one slight advantage: access to the Marcellus Shale.

So who will win the LNG race in the U.S.?

Let me take the guesswork out, which is precisely what my new investment report will do for you. Of course, the fact that these LNG exports are slated to begin this year means it’s imperative that you position yourself accordingly — before the investment herd catches on.

You’ll have full access to this report in just 72 hours… so keep a close eye out for my report to hit your inbox Thursday morning.

Until next time,

Keith Kohl

A true insider in the technology and energy markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the Managing Editor of Energy & Capital, as well as the investment director of Angel Publishing’s Energy Investor and Technology and Opportunity.

For nearly two decades, Keith has been providing in-depth coverage of the hottest investment trends before they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on key advancements in robotics and AI technology.

Keith’s keen trading acumen and investment research also extend all the way into the complex biotech sector, where he and his readers take advantage of the newest and most groundbreaking medical therapies being developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s to lab scientists grinding out the latest medical technology and treatments. You can join his vast investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.