Jealousy rages on across the lower 48 states.

It’s all thanks to the successful development of just three shale formations, which have become household names.

You should know them well enough by now: the Eagle Ford, the Bakken, and the Permian Basin.

These three areas in the continental United States are responsible for practically every extra drop of oil added to the country’s domestic production since 2008.

And thanks to the prosperity of these areas, there’s a growing resentment towards states like North Dakota and Texas.

As a result, we’ve happened upon front-row seats to an interesting development in the oil sector.

With the kind of continued success these two states can expect in the future, it only makes sense that less fortunate states would try to mirror this growth. And this is where the conflict arises…

Red Tape Ahead for Illinois

We can’t give Illinois any credit in the North American oil boom. The state’s annual production has averaged between 25,000 and 27,000 per day for the last five years.

The reality is Illinois’ oil output has been flatlining since 1999 (click chart below to enlarge).

If it’s an oil boom Illinoisans are looking for, they have a odd way of showing it. After fractivists failed in their efforts to get a moratorium passed on hydraulic fracturing passed, new laws were put in place to regulate oil and gas drilling in the state.

These regulations also happen to be some of the strictest hydraulic fracturing laws in the country.

And that’s a shame…

Let me show you what a real oil boom can do for a town.

Texas’ Economic Triumph

I heard a powerful prediction during my last visit to Midland last month. Just after hopping into my contact’s pickup to see one of his rigs, I learned how excited the local drillers were over their prospects in the area: “Pump jacks and power lines. That’s all you’re going to see from here on out,” he said.

Even though this is a sentiment I’ve shared for years, these Texan producers are finally getting their due…

Now, you have to understand that times weren’t so great not too long ago. People outside of Texas may take its oil for granted, but residents in Midland remember the painful oil bust thirty years ago.

You see, the oil boom that was kick-started in Mitchell County hit a breaking point during the 1980s. Crude prices dropped below $10, thanks to a glut in supply.

As I mentioned above, these people have been witnessing the tight oil boom firsthand for the better part of a decade.

Today, let’s take a look at the fruits of that drilling labor…

Midland is one of the fastest-growing towns in the United States. Population increased 4.6% between 2011 and 2012, easily the highest growth rate in the country. And the 3.2% unemployment rate there rivals that of North Dakota — and roughly half of the Lone Star State’s rate of 6.4%.

However, Midland’s stake in the Permian Basin comes with more advantages than job growth. Residents also saw their incomes dramatically rising. Back in 2009, the average income in Midland County was about $51,000. Within two short years, that amount jumped almost 30% to more than $65,000.

Of course, the only place that topped Midland in this category was Odessa, another area with huge stake in the Permian Basin.

But there were other fortunes to be made in the Permian since the tight oil revolution began in 2008…

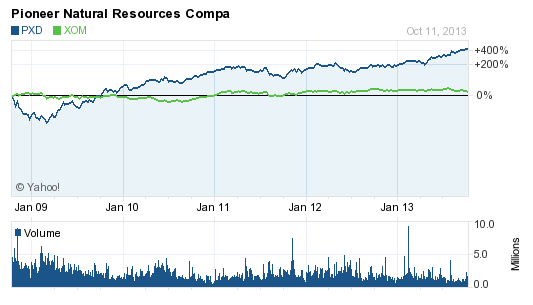

Investing your hard-earned money in Pioneer Natural Resources, one of the largest operators in West Texas, against one of the largest publicly traded oil companies in the world would have returned significantly different results:

The important thing to realize is that we’re still in the early stages of the Permian Basin’s oil revival, especially considering that Texas will soon be producing more than three million barrels per day.

Until next time,

Keith Kohl

A true insider in the technology and energy markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the Managing Editor of Energy & Capital, as well as the investment director of Angel Publishing’s Energy Investor and Technology and Opportunity.

For nearly two decades, Keith has been providing in-depth coverage of the hottest investment trends before they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on key advancements in robotics and AI technology.

Keith’s keen trading acumen and investment research also extend all the way into the complex biotech sector, where he and his readers take advantage of the newest and most groundbreaking medical therapies being developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s to lab scientists grinding out the latest medical technology and treatments. You can join his vast investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.