Yesterday, I mentioned that natural gas prices hit an eight month low Monday, yet one of the catalysts for prices rising as high as they did was the harsh winter we experienced.

Some of you might have noticed that our natural gas supplies were at a record low thanks to the increased demand from the polar vortex, and several analysts had predicted that we wouldn’t be able to make up the difference before the summer kicked into high gear.

However if you take a look at the monthly gas production numbers, you’ll see that didn’t happen…

In fact, in our shale gas fields alone, U.S. drillers shouldered the burden and outpaced demand, and it’s been enough to cause a bottom in natural gas prices.

So I guess we can start thanking the weather instead of blaming it…

But the real question here is whether or not you should play it?

As it stands now, the bullish outlook on natural gas makes it a great investment heading into the latter half of 2014. Even despite the fact that our profitability is threatened by a low-price environment – right now is an irresistible buying opportunity.

Think about it…

We’re starting to transition to more natural gas-fired plants in the wake of this supply glut.

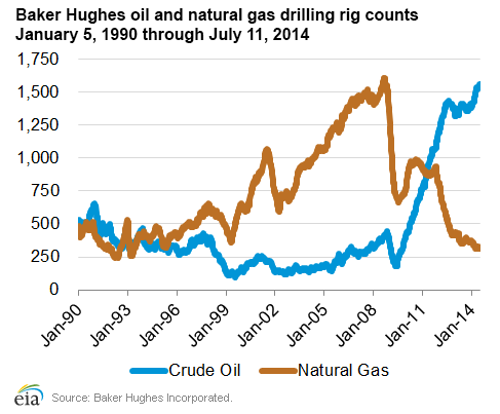

Moreover, nearly all of our domestic drillers have been moving away from natural gas by focusing on more liquids-rich plays. Can we really blame them? That’s where the money is now that WTI is comfortably trading north of $100 per barrel.

As you can see gas rig counts have dropped at an astounding clip, hitting a low not seen in 15 years.

Once demand starts to rise – which it will – expect prices to surge higher.

Unfortunately, timing is the most difficult part…

Like I said before, most analysts thought natural gas prices would be at least above $4 right now, maybe even $5. Instead, natural gas is at its lowest since November.

Then again, if our next winter is anything like the last one, there’s no question whatsoever that we’ll see gas at the henry hub trade upwards of $6… perhaps even higher.

If not, we always have LNG exports to look forward to. Don’t forget that the first shipments are expected to start as early as December 2015.

Now, couple these catalysts with the most recent EPA regulations against coal fired power plants, and we’ll likely see even more demand from utilities.

The bottom line here is that thanks to our glut, we’re staring at the best time to play natural gas for the long term, before prices start their inevitable climb and producers finally forget about oil.

Until next time,

Keith Kohl